Volume 2 Issue 9

December 1997

Milk Prices

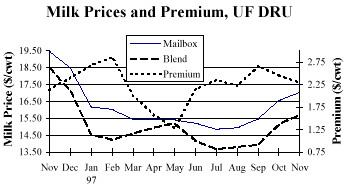

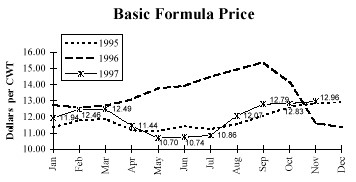

Florida milk prices are strong and will continue to rise through February. The Basic Formula Price (BFP) is expected to peak around $13.00 in December (to be announced Jan. 5th). The Class I price is based on the BFP two months earlier, so Class I prices should peak in February, 1998. The high Class I utilization rate in Florida means that our blend is dominated by the Class I price, so Florida blend and mailbox prices will also peak in February.

|

The graph of the BFP below shows that the BFP has been climbing since May. During the second quarter of 1997 production was up 2.6% nationally over the preceding year and consumption was down 1.9%. This soft demand relative to supply resulted in a lower than expected BFP during the summer. For the second half of the year consumption increased more than production, supplies tightened, and the effect is shown in the increasing BFP. The BFP for November is $2.26 higher than its low of $10.70 in May.

|

The actual mailbox price in February will depend on the premium, among other things. The premium has been eroding since September and will continue down in January. When the BFP rises, the premium usually gives back some of the increases made when the BFP was falling. The top graph shows this trend.

Interestingly, the Atlanta premium increased in October, and will remain steady through January. The difference of $1.35 between premiums in Atlanta and Upper Florida in September will narrow to $.42 cents in January.

|

Milk Feed Price Ratio

The graph at the right shows that the relationship between milk and feed prices has broken out of an 8 month slump. Hopefully this will continue through February with the expected strength in milk prices mentioned above.

-Michael DeLorenzo

Class I Milk Prices and Net Premiums* |

||||||

Nov 97 |

Dec 97 |

Jan 98 |

||||

| Location | Class I |

Premium |

Class I |

Premium |

Class I |

Premium |

| Atlanta | 17.07 |

1.20 |

17.11 |

1.20 |

17.24 |

1.20 |

| Up. FL | 18.48 |

2.11 |

18.48 |

2.07 |

18.16 |

1.62 |

| Tampa | 19.18 |

2.51 |

19.18 |

2.47 |

18.86 |

2.02 |

| Miami | 19.88 |

2.91 |

19.88 |

2.87 |

19.56 |

2.42 |

*

AnnouncedThe Dairy Situation and Outlook

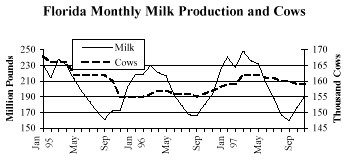

For the dairy industry nationally, 1998 is expected to be remarkably similar to the year just ending. Milk production will struggle to post any gains in the face of unchanged milk prices and still-high prices for concentrate feeds and alfalfa hay. Expected economic growth and retail dairy prices should favor growth in commercial use of dairy products, but demand pressures on prices may be mostly offset by the likely large stocks of skim solids at the start of the year.

In 1997, milk production recovered from its 1996 forage-induced drop but managed only a tiny increase from 1995. Returns were insufficient to spur much expansion in the face of high feed costs and very tight supplies of acceptable forage. Returns to dairying in 1997 were moderate overall but conditions varied greatly among farms. [This national result parallels what we found in Florida for dairies on the Dairy Business Analysis Project.]

Returns over concentrate costs for 1997 fell 11 to 12 percent from the relatively high 1996 level but stayed about 4 percent above the 1991-1995 average. Returns in 1997 were not enough to significantly alter the position of those producers under long-run income stress, even after the strong 1996 returns. These operations continued to exit from dairying at a fairly steady clip. On the other hand, the 1997 returns probably provided modest incentive for some farms to continue growing. This situation kept milk cow declines close to 1 percent.

In 1998, moderate milk prices, continued high concentrate feed prices, and tight supplies and high prices for dairy-quality hay are expected to curb expansion pressures. Milk production is projected to be just barely larger than in 1997 and might slip below a year earlier during parts of the year. Milk-feed price relationships will stay lackluster as declines in concentrate feed and hay prices are projected to be small, even with normal 1998 crops.

The Basic Formula Price (BFP) for milk is expected to decline steadily from the late 1997 peak of about $13 per cwt. through the spring of 1998. Large stocks of skim solids should enable the small expansion in milk output to meet the expected growth in commercial use. The first-half average BFP is projected to be near a year earlier.

Markets are expected to tighten significantly during the second half 1998. With stocks reduced and the Dairy Export Incentive Program back in business, strength in demand is projected to raise milk prices. The seasonal rise in the BFP is currently projected to be similar to 1997, but the potential for larger increases is clear.

Farmers received an average of about $14.35 per cwt. of milk in 1997, down about $1.50 from a year earlier but up about $0.60 from the 1991-95 average. Growth in commercial use was trimmed by the high prices for much of 1996 and early 1997 (at retail). This increased commercial use could not absorb the recovery in milk production. Even so, 1997 provided evidence that long-run prices may now be trending slightly upward (at least in nominal terms), as supply shifts have apparently slowed and steady demand growth continues.

Farm milk prices are projected to be about unchanged to slightly lower in 1998, assuming that the structure of Class I prices remains in place. Were it not for the large beginning stocks of skim solids, 1998 markets would be generally tight. Retail dairy prices in 1998 are projected to be about the same as in 1997.

Neither the farm price nor the farm-to-retail spread is expected to change much for 1998. However, the spread probably would be eroding faster if the price volatility of recent years had not made merchandisers reluctant to allow the spread to shrink.

Adapted from: "Livestock, Dairy, and Poultry Monthly," December 17, 1997, Economic Research Service, USDA.

Mailbox Milk Prices

"Mailbox milk prices" are calculated by the USDA for various regions around the country.

Mailbox prices for Sept. 97…

Florida (3 order avg.) 15.66

Southeast 12.82

New England 13.43 (includes effect of NE compact)

New York-New Jersey 12.51

Chicago 13.53

Up. Midwest 13.30

Texas 12.07

What is interesting to me, as I look at these prices, is that the Chicago and Upper Midwest have milk prices as high, or higher, than anywhere, except Florida. It is well known that the Upper Midwest region usually has the second highest prices nationally. The Northeast Compact only gets the Northeast prices in line with the Upper Midwest.

Also, those outside the Southeast and Florida often look to our region with envy – thinking our milk prices are unfairly high. How many would want to get our milk price, pay transportation into our market, and have the difference as their pay price? Transportation costs from Wisconsin are probably around $4.45, and from West Texas, $5.25, depending upon exact locations.

What are "mailbox milk prices?"

The "mailbox milk price" is defined as the net price received by farmers for milk, including all payments received for milk sold and deducting costs associated with marketing milk. All payments for milk sold include, where applicable:

over order premiums; quality, com-ponent, breed, and volume premiums; payments from state-run over-order pricing pools; payments from superpool organizations or marketing agencies in common; payouts from programs offering seasonal production bonuses; and, monthly distributions of cooperative earnings.

Costs associated with marketing milk include, where applicable: hauling charges, cooperative dues, assessments, equity deductions/capital retains, and reblends; the Federal milk order deduction for marketing services; Federally-mandated assessments; and advertising/promotion assessments above national program level. Other deductions, such as loan, insurance or feed mill assignments are not included.

- Michael DeLorenzoTwenty-Third Southern Dairy Conference

February 9-10, 1998

Atlanta, Georgia

Monday, February 9, 1988

Dairy Situation and Outlook - Mark Stephenson, Cornell

Federal Milk Order Reform

A National Perspective - Ed Coughlin, National Milk Producers Federation

Processor Perspective - Bob Baker, Barber Dairy

Producer Perspective - Joe Wright, Florida Dairy Farmers, Inc.

Impact of Deregulation of the Dairy Industry - John Seibert, Texas A & M

Improving the Competitiveness of the Southern Dairy Industry

Declining Southeastern Milk Production: Causes and Reasons - Hal Harris, Clemson

How to Encourage Expansion of Milk Production - John Smith, Kansas State

Impact of Technology - Richard Fleming, Market Administrator, Texas & New Mexico Orders

Herd Management - Don Bennick, North Florida Holsteins

Production Systems - Max Sudweeks, Overton, TX

Promotion Update - Bob Earle, SUDIA

Tuesday, February 10, 1998

The Southern Dairy Compact - Geoff Benson, North Carolina State University

Impact of Changes in the Processing and Retailing Structure - Don Blayney, ERS, USDA

Dairy Cooperative Consolidation - Gary Hanman, Mid-America Dairymen, Inc.

Dealing with Large and Small Coop Members - Rick Smith, Dairylea

This looks like an excellent program, covering a number of issues that are timely and will have material effects on dairy producers in the Southeast.

If you would like more information or a registration form, contact Mika at (352) 392-5594.

1998 Price Forecast

Price forecasting is risky business, but it’s like doing a budget for the coming year. It’s true that everything is not controllable, but that’s no reason not to plan. It’s been our experience that the dairies which are the most profitable consistently do forward planning, and this requires forecasting prices. Invariably this leads to keeping pressure on reducing production costs per cwt. milk sold - because dairies which do this planning stare at the reality of the coming year rather than living on hope alone.

|

So what’s the forecast? The Outlook from the USDA on this page says milk prices for 1998 will be about the same as 1997, or slightly lower. Other economists are guessing milk prices will be slightly higher. A graph of the average of 11 different forecasts for the BFP is show at the right. The average for the year is about $.15 higher than 1997.

-Michael DeLorenzo

Florida Dairy Extension

| Andy Andreasen - Jackson Co. | Wayne Odegaard - Hernando Co. |

| David Bray - Dairy & Poultry Sci. | Travis Seawright - Manatee Co. |

| Michael DeLorenzo - Dairy & Poultry Sci. | David Shannon - Calhoun Co. |

| Roger Elliott - Escambia Co. | David Solger - Washington Co. |

| Shepard Eubanks - Holmes Co. | Mary Sowerby - Multi-county |

| Russ Giesy - Multi-county | Charles Staples - Dairy & Poultry Sci. |

| Mary Beth Hall - Dairy & Poultry Sci. | Robert Tervola - Suwannee Co. |

| Larry Halsey - Jefferson Co. | Paulette Tomlinson - Columbia Co. |

| Pat Hogue - Highlands Co. | James Umphrey - Dairy & Poultry Sci. |

| Patrick Joyce - Duval Co. | Jack Van Horn - Dairy & Poultry Sci. |

| Elzy Lord - Alachua Co. | Chris Vann - Lafayette Co. |

| Pat Miller - Okeechobee Co. | Marvin Weaver - Gilchrist Co. |

| Roger Natzke - Dairy & Poultry Sci. | Dan Webb - Dairy & Poultry Sci. |